[Note: 2019 update in IMF working paper 2019: Global Fossil Fuel Subsidies Remain Large: An Update Based on Country-Level Estimates.]

Well, ATTP tweeted it, poor trusting soul that he is, having been unwise enough to believe the Graun’s headline, which segues into text Fossil fuel companies are benefitting from global subsidies of $5.3tn (£3.4tn) a year, equivalent to $10m a minute every day, according to a startling new estimate by the International Monetary Fund. The report itself says:

A key factor in estimating the magnitude of current subsidies is which definition of “subsidies” is used. Pre-tax consumer subsidies arise when the price paid by consumers (that is, firms and households) is below the cost of supplying energy. Post-tax consumer subsidies arise when the price paid by consumers is below the supply cost of energy plus an appropriate “Pigouvian” (or “corrective”) tax that reflects the environmental damage associated with energy consumption and an additional consumption tax that should be applied to all consumption goods for raising revenues. Some studies also include producer subsidies, which reflect the net subsidy given to energy producers (for example, through access to subsidized inputs, preferential tax treatment, or direct budget transfers) although these are typically much smaller than consumer subsidies (OECD 2013).

The difference between pre- and post-tax subsidies is the “externalities” (see-also Agricultural land value as a percentage of GDP, and the comments thereon; note how opposed many were to the concept of externality; perhaps now it turns into a presumed tax on fossil fuels they’ll be happier).

I’m uncomfortable with regarding not imposing externality taxation as a subsidy. In particular, its not a subsidy to the company that extracts and sells the fuel (or at least, only a fraction of it is, since it probably eases their business). Its mostly a “subsidy” to the consumer, who then pays, of course, in terms of the externality. And note that most of the externalities are “local” to the country, rather than global: chiming with what I’ve said before and with Eli’s recent Heartland Institute – Convenient Cognitive Dissonance, they say Most [post-tax] energy subsidies arise from the failure to adequately charge for the cost of domestic environmental damage—only about one-quarter of the total is from climate change. Note that’s merely an issue of terminology: I strongly support the idea that externalities should be internalised, via appropriate taxation.

I’m dubious about

The fiscal, environmental, and welfare impacts of energy subsidy reform are potentially enormous. Eliminating post-tax subsidies in 2015 could raise government revenue by $2.9 trillion (3.6 percent of global GDP), cut global CO2 emissions by more than 20 percent, and cut pre-mature air pollution deaths by more than half. After allowing for the higher energy costs faced by consumers, this action would raise global economic welfare by $1.8 trillion (2.2 percent of global GDP).

This sounds like the free money tree that the FTT people think they’ve found. Those people are definitely wrong; these people I’m less sure about. Discuss. They do say These findings must be viewed with caution (of their findings in general, not just that one).

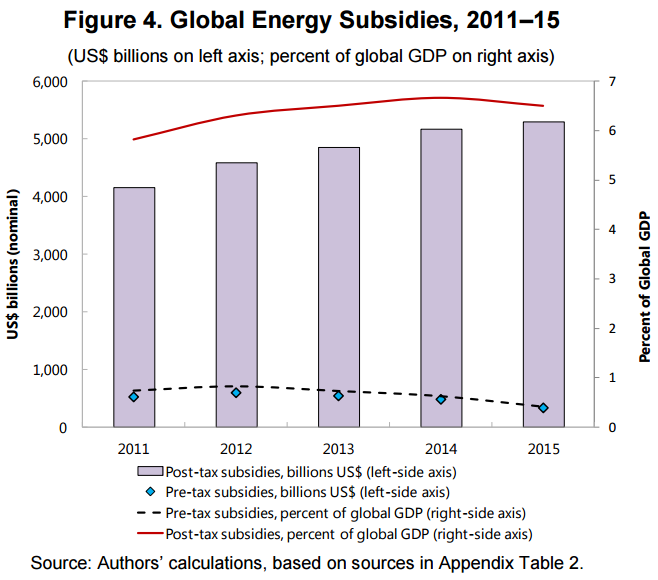

Anyway, here’s their Key Figure:

As you see, pre-tax subsidies, which I’m sure we can all agree are definitely naughty, are declining. Oddly enough, they don’t find any space to mention that in the intro, which concentrates on the post-tax subsidies. Which are going up. Post-tax subsidies are, approximately and by eye, ten times the pre-tax ones.

They note that these large numbers are more than twice as big as their previous numbers, because of (1) expanded coverage of air pollutants… also include damages from nitrogen oxides and direct fine particulate emissions (2) recent evidence from the World Health Organization suggesting air pollution has a greater effect on mortality risk; adjustments for country-specific sulfur dioxide emission rates from coal plants; adjustments for country-specific population exposure to coal plant emissions; adjustments for differences in baseline mortality rates (less healthy populations being more vulnerable to pollution); (3) extrapolation of congestion, accidents, air pollution, and road damage for vehicles; (4) the use of country-specific conversion factors.

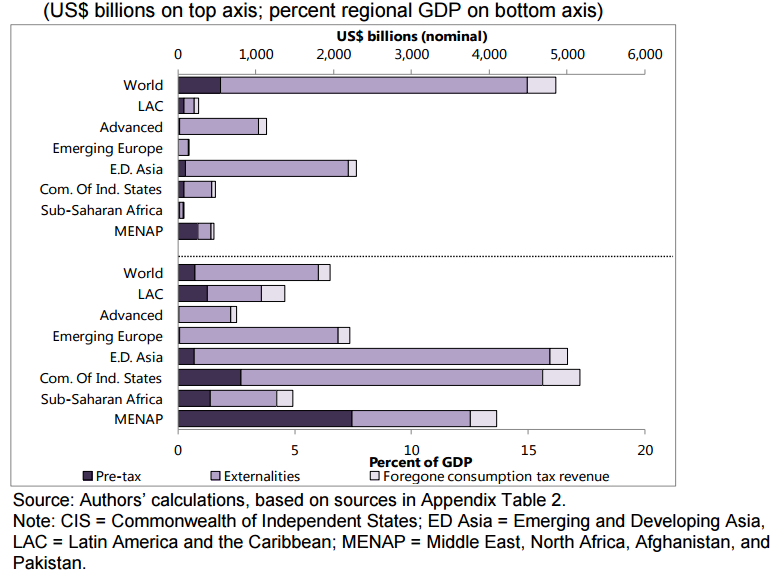

The split into regions is what I’ve been waiting for, and comes in figure 7:

As you’d expect, most of the pre-tax subsidies are in the banana republics: the middle east, Russia, and bits of S America with more oil than sense. The bulk of the post-tax subsidies are China, with about 50% and “advanced” (i.e. us), with another 25% (by eye).

That rather tailed off without a conclusion, didn’t it? Well, the conclusion is that explicit subsidies are a small fraction of total externalities.

Refs

* IMF Report On $5.3 Trillion In Energy Subsidies; Careful, It’s Not Quite What You Think – Timmy. He makes more forcefully the point I made rather sketchily: that these aren’t subsidies to fossil fuel companies, but to consumers. But oddly he fails to notice that the bulk of the externality is local pollution, not GW -W]

* Timmy again, pointing to Quantifying the implicit climate subsidy received by leading fossil fuel companies, which is making the same kind of mistakes.

* [2021] Unusually, Vox’s The IMF says we spend $5.3 trillion a year on fossil fuel subsidies. How is that possible? by Brad Plumer gets it right (and quotes Timmy and, I now notice, me as well).

Well, ATTP tweeted it, poor trusting soul that he is, having been unwise enough to believe the Graun’s headline

RT doesn’t mean endorsement, as I assume you know? I’m trying to understand your post. Essentially, you think that calling an untaxed externality a subsidy is wrong/poor terminology, but you don’t disagree that there are quite large unpaid (upfront, at least) externalities, and that these are much larger than the actual subsidies?

[:-). I’m dubious about calling the externality a subsidy (but, its just terminology, so fundamentally not important). I’m certain that calling it all a subsidy to (evil fossil fuel) companies, as the Graun does, is wrong. And yes, the idea that the externalities are significantly larger than the explicit subsidies seems quite plausible -W]

LikeLike

I’m certain that calling it all a subsidy to (evil fossil fuel) companies, as the Graun does, is wrong.

Yes, I would agree with that; well apart from presumably that they have a competitive advantage without it. Did they really say “evil fossil fuel”? 🙂

[I added “(evil fossil fuel)” of course. That was intended to be obvious. As to the “competitive advantage” yes I think so (I alluded to that, if you look closely) but I strongly suspect that’s only worth a small fraction of the “subsidy” aka externality -W]

LikeLike

Well, the good ole IMF?

Where virtually free gas in Venezuela, Russia, Saudi Arabia, Nigeria, etceteras are all considered subsidies?

F*** **uck Yea!

Next up for the IMF?

111% of gross world product is subsidized. D’oh!

Me being the ultimate food Nazi, all I can say is, I wonder how long the IMF can survive eating their own printed reports?

LikeLike

Yo!

Well it is a subsidy and the fuel companies are benefiting from them as the article say…. Depending on how you do the “math” it could be higher or lower.

[I think you’ve misunderstood: the fuel companies don’t get the whole benefit. The Graun is being unthinking. Fuel currently costs X per barrel, and Y barrels are sold. Suppose fuel were taxed to impose the full externality; something like 9*X, so the full price is 10*X. Previously, fuel companies made some fraction of X, perhaps 1/10. After, they likely still make X/10, but perhaps now less fuel is sold, reflecting the higher price. Perhaps, half: Y/2. So instead of XY/10, companies now make XY/20. Whereas the total “subsidy” was XY*9. So the company makes only 1/9*20 of the “subsidy”. Disagree? Then what fraction of the “subsidy” do you think is flowing to the fuel company? -W]

LikeLike

Pretty much any fuel source will subsidize 100% of gross world product. D’oh!

This isn’t rocket science.

Speaking of rockets, I do wonder when we all will get to Mars using only 100% renewable (non-fossil or nuclear) technologies?

Don’t hurt yourself.

LikeLike

Chuckle. How about adding the estimates being made of the hidden costs? Yeah, it’s an early warning “Although data are lacking on attributable risk of specific pollutants and relationships between trends in pollution and rates of disease …” and correlation is not causation and yadayada we know.

Like I said in the earlier thread, talk to the epidemiologists, not the economists, to get an early start on the numbers:

http://www.ncbi.nlm.nih.gov/pmc/articles/PMC2516589/

LikeLike

Were ex-post-facto environmental impact taxed, Kew Gardens might outstrip BP as a ratepayer-

250 years of homogenizing the biosphere is a lot of red ink.

LikeLike

So wrt those ‘so called’ externalities, who’s been keeping those set(s) of books since the dawn of time?

Why are these ‘so called’ externalities just about now seeing the light of day.

And why do those externalities keep on increasing like 2X each time the DN’s at the IMF do these type of spurious calculations?

I mean FF’s have been around since we’ve been burning wood. Or so I’ve been told.

Where do I mail my reparations monies? Nigeria or C/O Africa?

“Disclaimer: This Working Paper should not be reported as representing the views of the IMF. The views expressed in this Working Paper are those of the author(s) and do not necessarily represent those of the IMF or IMF policy. Working Papers describe research in progress by the author(s) and are published to elicit comments and to further debate”

[The concept isn’t new, as you know. But doing the calculations isn’t easy, so its not surprising they’re not fully worked out. And its only moderately recently that there has been any chance of suitable taxation being imposed (don’t hold your breath though) so only recently much point -W]

LikeLike

The IEA 2014 World Energy Outlook found that globally, producer subsidies (i.e. not including externalities) for fossil fuels were $550bn in 2013, and for renewables were $104bn.

I know this reflects their differing TWh outputs, but it slightly counters the idea that renewables rely on handouts and fossil fuels are untainted by such a thing. Also, consider the public money poured into the construction and operation of fossil fuel generation in non-‘banana republic’ countries over over 4.5 decades between WW2 and 1990.

LikeLike

…the fuel companies don’t get the whole benefit. The Graun is being unthinking.

Well, the headline actually says ‘fossil fuels subsidised’, not ‘fossil fuel companies subsidised’. Perhaps your beef is with the opening paragraph rather than the headline?

[That’s what I said, so yes -W]

LikeLike

“The IEA 2014 World Energy Outlook found that globally, producer subsidies (i.e. not including externalities) for fossil fuels were $550bn in 2013, and for renewables were $104bn.”

Those, of course are absolute numbers.

What was the “GDP” of all FF industries, say very ballpark $10T (or $5T if you prefer, but I think $10T is a more reasonable number IMHO). So ~$5B is only 5-10% of total FF “GDP”

Meanwhile back at the ranch, what percentage of total energy is produced (converted to $) from FF versus renewables (minus hydro, as that’s been around forever and tree huggers don’t like hydro, e. g. Glen Canyon Dam))?

So another ballpark number, renewables 5% (high number, 5% hydro not included), and 90% FF.

So 5%/90% = 1/18

Or per dollar energy cost $550B/18 = $30.5B per 5% FF energy cost direct subsidy versus $104B per 5% renewables energy cost direct subsidy.

This isn’t rocket science.

Speaking of rockets, I do wonder why we are even trying to go to Mars when we’re currently stuck with century old rocket technology with an escape velocity of only ~40KPH?

NOTE: I’m 100% behing having a carbon tax if 100% of those tax dollars goes into renewables. No robbing Peter to pay Paul.

LikeLike

“Meanwhile back at the ranch…”

And do you suppose that US coal and gas fired power stations built over the last 100 years were financed without tax breaks, cheap loans, subsidised coal, price support and other sweeteners? That is was an entirely free market plus some brave investors? This is certainly as true for Europe as for the USA. My point is that the renewables sector (apart from big hydro) is still nascent, and it’s hardly unprecedented that power generation informed by a societal need (back then, electricity volume + affordability; now, volume + low carbon + affordability) gets a leg-up.

LikeLike

Well, this is an odd case where the headline is more accurate than the article. But your point seems, on the grand scale of things, a quibble. The real issue is the size of the externality.

And based on what you say above regarding why the account doubled, I suspect that climate impact component of the externality has been discounted, underestimated, and/or not tail-risk-weighted, because the climate cost of fossil fuels ought to overwhelm those smallish details.

[Well, I did wonder if someone would come in on that point. I expected you to think that “the climate cost of fossil fuels ought to overwhelm those smallish details” (my bold; said “details” including many people dying early). Can you justify your “ought” with numbers? -W]

LikeLike

Might be my English….

But neither the headline or the article say it all go to the companies? So my take… there exists subsidies they might be larger or smaller then in the article depending on how you do the math.

[Are we reading the same thing? The bit I quoted says “Fossil fuel companies are benefitting from global subsidies of $5.3tn (£3.4tn)…” -W]

LikeLike

> 250 years of homogenizing the biosphere is a lot of red ink

250 years of carbonating the atmosphere, likewise

LikeLike

“Speaking of rockets, I do wonder when we all will get to Mars using only 100% renewable (non-fossil or nuclear) technologies?”

Liquid hydrogen and oxygen, the same way we got to the moon (do try harder please)

LikeLike

Most of the pre-tax subsidy in Russia and banana elsewhere is the graft that was used to capture the resource. Of course that is not included.

LikeLike

“Liquid hydrogen and oxygen, the same way we got to the moon (do try harder please)”

Good. We agree one one thing. There is no such thing as 100% renewables.

LikeLike

I had more or less sworn off commenting on blogs, but William, you are getting prematurely crotchety. You had no call to insult ATTP the way you did over the tweet, especially since the interpretation of what is a “subsidy” in the Guardian article was well spelled out and to many people (myself included) would be a perfectly reasonable understanding of the word. For that matter, your continued hostility to the Guardian (including the infantile reference to the “Grauniad”), which is doing some of the best press coverage of climate issues is getting tiresome and mildly offensive.

[ATTP and I know each otehr well enough for little digs like that. “Grauniad” is a Private Eye-ism; were you not aware of that? http://www.urbandictionary.com/define.php?term=grauniad etc -W]

You were also rather dismissive of Michael Tobis’ remark about the lowball estimate of the climate damages. He is spot on, and you are being needlessly offensive in attributing that to wishful thinking. The general level of climate damages cited in the Guardian article are Nordhaus-like, which means something like a 3% discount rate, neglect of any chance of high climate sensitivity, and neglect of very high emissions scenarios. In a Sherwood/Huber world with high climate sensitivity and 5000 GtC emissions, tropical agriculture collapses and mammals can’t survive outdoors over much of the world. A world like that is incompatible with 3% economic growth, and if anything requires a negative discount rate.

[I don’t understand why you’re talking about emissions scenarios. The damages dicscussed in the Graun and IMF reports are per-C, so are scenario independent, to first order -W]

The real lesson to be derived from the report summarized in the Guardian, which you would have realized if you weren’t so busy being snide, is that even if you zero out the climate part of the damages of fossil fuel usage, the effective subsidy to fossil fuels from other collateral damage is huge. This echos what Richard Alley has been saying about coal for quite some time — the actual social value of coal, even without factoring in climate damages, is negative.

[I don’t know why you’re being so offended; I agree that there are significant negative externalities to coal burning. But I also think that Fossil fuel companies are benefitting from global subsidies of $5.3tn (£3.4tn) a year, equivalent to $10m a minute every day, according to a startling new estimate by the International Monetary Fund is (a) wrong and (b) not in the report (c) something the Graun has made up because they don’t understand economics and (d) something you’re rather pointedly ignoring -W]

LikeLike

HR,

“250 years of carbonating the atmosphere, likewise.”

Exactly.

That’s what I was trying to say. But not just in regards to FF, but to all human endeavors.

If one is to start bookkeeping today, one must reflect on all manner of bookkeeping into the known past. And convert those to NPV or current $.

Slavery. Discrimination. Genocide. War. Human sacrifice. EPA Superfund sites. Poverty. Lack of good health care. Child labor. Over population. The list of past atrocities is virtually endless.

So, I say, let’s 1000X the FF externalaties (SLR alone ought to be > $100T). Make that front page news in all the MSM.

I can’t think of a better way to totally alienate the rest of humanity from the Boomer Doomers.

LikeLike

Well I do not know but this is how I read it.

The companies are benefiting from subsidies which is correct

The subsidies are of so and so much money which is correct (and the number could be higher than that if you calculate it differently.)

what was wrong?

[Um, I’m not sure how much simpler I can make this: the “subsidies” are primarily to consumers, not to producers. I provided some numbers. Did you read them? Remember John McCarthy: “He who refuses to do arithmetic is doomed to talk nonsense” -W

LikeLike

Well the point is I can not see that the article say that all the subsidies goes to the companies or producers just that they benefit from them and they do that even if they go to consumers.

[Don’t you think that anyone reading the quote would naturally think, if they believed the Graun, that the subsidies were flowing mostly, if not entirely, to the fossil fuel companies? Why do you think the Graun chose to write “Fossil fuel companies are benefitting from global subsidies of $5.3tn…” when a more accurate version would be “Consumers of fossil fuels are benefitting from global subsidies of $5.3tn…” Do you think that was an accident? I don’t. Firstly, I think that the people who wrote it were probably too dumb to realise the distinction. Secondly, I think that the people that wrote it were biased: they are quite happy to be outraged at fossil fuel companies receiving subsidies; were they forced to realise that it was consumers, they would have written the text very differently -W]

LikeLike

Since I can’t help but look for some way to disagree with anyone who’s agreeing with me, I have to question that:

“one must reflect on all manner of bookkeeping into the known past”

I think that’s going to make tracking this stuff ridiculous.

Beancounting and trying to attribute responsibility to the grandchildren of the pirates and stripminers just fails.

Trying that gets you laughed off the blog.

The real problem I think is the “damn the collateral damage as long as it’s someone else, full speed ahead” attitude, which I read in the breakthrough types who are hangers-on around the fringes of a few somewhat sensible ecopragmatists.

LikeLike

It is ok you could just say I am right 😉

Sure it was a bad headline, happens a lot in papers thees days. Perhaps some ppl read it that way I did not but could be because I know how it works… Any way both the companies and the consumer are benefiting from it. If the gov put the money elsewhere perhaps the ppl would benefit more not the producers though… all this is not as easy at it seams.

Agree that it would have been a better article if it was clearer though.

LikeLike

Raypierre: “very high emissions scenarios.”

W: ” per-C, so are scenario independent, to first order -W]”

High emissions = higher rate of change = more damage per-C?

—–

A plea, I hope you two in particular stay engaged here and work to make each other clearly understood. That’s needed.

LikeLike

Because of a lack of transparency in many countries, the true cost of direct subsidies probably isn’t known. The Guardian is not the first to look at the situation and come up with *very* large numbers. From Oil Change International:

* $630 Billion in Consumption Subsidies in Developing Countries (International Energy Agency)

* $45 Billion in Consumption Subsidies in Developed Countries (Organization for Economic Cooperation and Development)

* $100 Billion in Producer Subsidies in Developed Countries (Organization for Economic Cooperation and Development)

* $80 to $285 Billion in Production Subsidies in Developing Countries

* $15 to $150 Billion in Financing from International Financial Institutions (IFIs) and National Development Banks

* $50 to $100 Billion in Financing through Export Credit Agencies (ECAs)

* $20 to $500 Billion for Securing Fossil Fuel Supplies (Military Subsidies for Fossil Fuels)

I think you also underestimate the effect on sales if the externalities of fossil fuels were properly accounted for in the transaction cost when you say: “In particular, its not a subsidy to the company that extracts and sells the fuel (or at least, only a fraction of it is, since it probably eases their business). Its mostly a “subsidy” to the consumer, who then pays, of course, in terms of the externality. this might have been true in the past, when there were few alternatives,but it’s less and less true today. Sure it’s a “fraction of it” – but 1/10 and 9/10 are both fractions. Many consumers are already moving to solar and wind and if the externalities were properly accounted the net effect wouldn’t be the consumer paying more for fossil fuels, but simply moving to a more attractive product. I doubt very many new residential homes would be built using gas or coal-fired electricity for heating, cooling, and cooking if the externalities were in the transaction costs.

Just as important is the fact that we’re simply ignoring the long-term cost of the externalities. The consumer isn’t paying most of the cost – it’s just building up as a huge debt that someone, somewhere, sometime down the road will have to payoff – or we just default on it.

[Well of course. That’s the consequence of them being externalities. Though notice that the bulk of the externalities – the actual damage, not the true-subsidy – is paid in local, short-lived pollution leading to death; at least, that’s in the present analysis. So, not actually long term debt -W]

Unfortunately we all know that barring some transformational sequestration technology, we will reach a point where our ability to payoff the debt will have passed and many will still deny there’s even a problem.

LikeLike

My understanding of economic theory is that a subsidy or a failure to price an externalize are both going to have exactly the same distorting effect on the market and result in consumption in excess of the point where the net benefit to society for increased consumption is exactly balanced by the net cost to society of increased consumption. However a subsidy will have an administrative cost, and failure to price an externality is free.

Economic theory also suggests that it doesn’t matter to which party a subsidy is given to, but it is rather the relative market power that determines who gets the benefit of a subsidy. Market power is determined by elasticity of demand and supply, and distorted by monopolies etc. For instance if the seller has a perfect monopoly, then even if the purchaser is given the subsidy the seller will raise price and take the entire benefit of the subsidy. If the seller is in perfect competition with no market power and assuming the subsidy is given to all competitors then 100% of the subsidy benefit is passed on to the purchaser as all competitors reduce prices to maintain competitiveness.

[That’s a good point; but notice that it doesn’t apply to the not-really-a-subsidy of the unpriced-in externalities. In the case of fuel price subsidies: as I understand it, those are primarily banana republics ensuring that their citizens are “bought off” with cheap energy, so I think the consumers get the subsidy in those cases -W]

LikeLike

>”Perhaps, half: Y/2. So instead of XY/10, companies now make XY/20.”

Few companies survive a shock halving of their sales, so XY/10 could more than disappear if done too suddenly. Could well be different if all competitors similarly affected. Nevertheless hopefully no-one sensible would really try to introduce carbon tax of over £100/tonne overnight.

.

Re Scenarios:

Solar and wind are cheaper than FF both before paying initial capital costs and after paying initial capital costs even without considering the externalities. So at what point should we recognise that the BAU scenarios should have FF phased out over remaining lives of installed FF plant?

Does this make the job of justifying that change is needed harder? So will people with an agenda of wanting to force changes to happen sooner quietly ignore this for some time?

LikeLike

Hank,

Well I see that we agree again.

So 100 years from now these ‘so called’ externalities will have been kept track of, of course?

[No. The idea is that the externality cost is factored into *today’s* prices, so there is no need for tracking into the future -W]

There will be a Bank of Externalities, which no matter what humanity does, will always be in red ink, ad infinitum, ad nauseam.

There will be a Futures market in Externalities, it’s true value will always be a fraction of a penny on the dollar.

The stock market will have many corporations based solely on Externalaties, these will never make any REAL money, and even if they do, the payout is at least 200 years into the future.

Oh and on those current IMF ‘so called’ externalities, what’s the current net benefit from FF use on life expetency and total population?

http://en.wikipedia.org/wiki/Life_expectancy

We’ve ~doubled life expectancy in the last 100 years.

That’s why certain Boomer Doomers (some have already commented above (and why are they always white males, kind of the anti-stereotype of the old white male Deniers), former dirty hippies who protested the Vietnam War, or some such). Oops, this is turning into a classic rant/screed/manifesto. Let me reboot that last thought sans crazy talk (well it’l still be crazy talk).

That’s why certain Boomer Doomers don’t like the current IMF calculations, as we’ve actually had net positive externalities to date due mostly to FF (see life expectancy above).

Boomer Doomers say AGW grossly underestimated in current IMF externalaties calculation, or some such.

Show me the money! In cold hard bullion, at the Faux Bank of Externalaties.

What’s the discount rate? Some number between -100% and +100%. Kind of makes the IPCC ECS estimate range look like a rock solid single value number.

Bye.

LikeLike

While you’re right that most of the subsidy is to FF consumers rather than FF producers, there is a logical flaw in your example (reply to comment 4) in which 10x price, 1/2 sales implies FF producer only pockets 1/180 of the subsidy. The flaw is that if eliminating the subsidy pushes FF prices over a threshold where renewables are obviously preferable, it won’t be 1/2 sales, it’ll be 0 sales. The entire value of every FF company will drop to zero. So the exact fraction of the subsidy they’re pocketing is unimportant to FF producer shareholders – what’s important is that the value of their entire holding is 100% subsidized.

[OK, but even accepting that, the maximum subsidy is “sales” which is still a small fraction of “externality”; so the bulk of the “subsidy” still goes to the consumers -W]

Sure I’m being a little simplistic in that there are multiple thresholds for different types of energy usage, and transition to renewables will take some time (but seriously, if FFs went 10x in price tomorrow, the transition would be faster than you might think!) however, the ultimate point remains the same – any carbon that must remain in the ground is worth zero dollars. If rates of extraction fall to a few percent of current (say, as air travel is the last big FF user after others transition) then the FF companies stocks are essentially worthless.

LikeLike

“if FFs went 10x in price tomorrow”

I can’t even fathom someone saying such a thing, but you did, so I’m game.

Get all FF prices raised by 10X starting at 12:00 UTC 2015-05-19 (~28 minutes and counting).

No one get’s fired. World economies don’t collapse. The Greatest Depression does not happen. Worldwide FEMA-like concentration camps are created to make people spend 2+ decades making corrugated metal shanty town like 100% renewables that give each person 30 seconds of electricity).

LikeLike

Michael Hauber,

“My understanding of economic theory …”

http://en.wikipedia.org/wiki/Schools_of_economic_thought

My understanding of economic theory is less than absolute zero!

You will get as many different answers from economists as there are economists (on a daily, if not hourly, basis).

Where are all the trillionaire economists? I mean, they all purportedly know so much about the economy, they all should be able to turn a penny into a trillion dollars.

Of all the fields of ‘soft’ science, economics is the worst, equivalent to dowsing.

LikeLike

EFS – He wasn’t suggesting it as a policy choice, he was using it as an illustration to make a point. If people knew their coal-fired electrical power plant was going out of business they’d not only look for alternatives they’d *demand* them. So I’d agree with Greg, you might be surprised how quick the transition could be. Overnight, no. But we could double or treble the growth of alternatives if we simply *chose* to do so.

LikeLike

What people are trying to tell you Weasel, is that the subsidies to the consumers maintain the market that the fossil fuel companies depend on. That is a subsidy to the fossil fuel companies.

LikeLike

Eli,

I do think that most people, in the USA at least, think of subsidies as direct subsidies, such as a direct tax break or as appropriations enacted as Congressional funding.

So while you will argue that anything and everything is a subsidy, and the IMF did use Subsid* like a jillion times (invoke Godwin’s law reference here for propaganda-like impact), IMHO most people don’t immediately think of a subsidy as including all costs covering literally several millenia. I know that I didn’t when William brought up this subject in the recent past.

The Gaudy clearly misrepresented the IMF (see the IMF’s own disclaimer statement) as well as not correctly separating the estimated costs into there various components (basically direct subsidies and externalaties).

I seriously doubt that we can ever get to the true costs of FF’s to even the correct order of magnitude, perhaps it’s more like two orders of magnitude (+/- one order of magnitude in either direction).

There are those of us who will make absolutely certain that the general public fully understands this three card monte/shell game for what it really is.

Flaky economists pulling numbers out of their backsides, because that’s generally what all they do. Speaking of Tol, I do wonder what he would say on such matters as the IMF Imaginationland numbers.

I’ve never in my entire life ever written a letter to any congressperson, we have two very deep red senators, keep on pushing those buttons, P-L-E-A-S-E!

LikeLike

Maintaining a market is a subsidy. That’s a period.

[Mmm, but to whom? I see a lot of denial in the comments here: people insist on fossil fuels companies = evil, consumers = good; therefore, consumers can’t be getting the bulk of the subsidy. Approximately equivalent to David Bellamy’s logic: “I don’t like windfarms; windfarms a re aresponse to GW; therefore GW = wrong” -W]

LikeLike

> The idea is that the externality cost

> is factored into *today’s* prices

I am guessing you mean _should_ be_, not “is” factored into today’s prices?

If so, that ignores the lag time before the cost accrues.

[The time lag is irrelevant to the externality cost except insofar as it gets factored into the present-day cost, via discount rates -W]

The dose is the poison.

LikeLike

It’s the “oops, whoda thunkit” externalities, the kind that ‘economics and politics’ is so unfailingly eager not to actively seek out in order to take into account in pricing, that worry me. The market doesn’t get this.

E.g.:

http://www.eurekalert.org/pub_releases/2015-05/dc-mpi052015.php

“Forest soils typically store large amounts of pollutant metals from human activities, particularly the burning of coal and lead gasoline, but the researchers found that New England’s non-native earthworms are bioaccumulating those metals, especially lead and mercury, to levels that are potentially toxic to predators. The findings suggest that invasive earthworms have a larger role than currently thought in the amount and fluctuation of pollutant metals in forests of the northeastern United States.

“Our results suggest that exotic earthworms could be responsible for the high levels of toxic metals in ground foraging animals such as birds, amphibians and even mammals across New England,” says lead author Justin Richardson (https://earthsciences.dartmouth.edu/people/justin-richardson)…. “Our research highlights two important messages: Earthworms are not native in the forests of New England and they may negatively impact what forest soils do well: retaining pollutant trace metals from food webs.”

LikeLike

WC writes: “Though notice that the bulk of the externalities – the actual damage, not the true-subsidy – is paid in local, short-lived pollution leading to death; at least, that’s in the present analysis. …”

Oh wel then, nevermind. Here I thought the longterm *important* externality was the increasing concentration of CO2 in the atmosphere and what that portends for the planet’s future climate. My bad.

LikeLike

So just wondering.

Is the IMF the only one with skin in this externalaties game?

Because I’m looking for CATO/Hartland/Tol type numbers where FF prices ought to be an order of magnitude LOWER then they currently are.

I’m also looking for mt/raypierre/Krugman type numbers where current FF prices should be like a trillion dollars a gallon/gram.

I’d really like externallity numbers that vary by like ten orders of magnitude, or some such. I’m such a Wanker!

You see, I do think we should move to ~100% renewables ASAP. And yes, through government actions. But economics, the shoddy ‘science’ that it is, for me at least, plays absolutely no part in that belief system.

Somewhat finally, I really do like the huffy-puffy ‘Nowhere Man’ public intellectuals (they know who they are because they just can’t shut the f*** up), telling the Starvin’ Marvin’s of the world how to behave, it’s kind of like ‘The Man’ keeping them down. I wonder if the Starvin’ Marvins of the world have their own opinions? (rhetorical question)

Those public intellectuals are a lot like Monkers, with their vile tone of voice and their general demeanor (see prime example above).

I live in a double wide shotgun house in The Bottom, I’m about to make it to seven months on a single tank of gas (city with no real public transportation), no offspring, not saving the planet, as I’m an ascetic (aka cheapskate, a day-to-day life (absolutely no savings), living a monk-like existence. Money means nothing to me. I’m effin’ free range, no borders, no societal boundaries.

Anyways, back to those externalaties, I’m now thinking it’s nothing but circular reasoning or tautological, no real bookkeeping, that can’t possibly happen, as we end up following only one path. The repercussions of other paths not taken will never be known, they can only ever be imagined, ergo Imaginationland, humanity seems to be really good at that one.

LikeLike

> [The time lag is irrelevant to the externality cost …

An example would be welcome.

[If I emit X CO2 that is calculated, by one means or another, to cause future damages of D(y) in year y, where y = 2015, 2016, …; and the discount rate is X%, then the total damage is D_total = sum_y=[2015,infinity]{D(y)*(1-X/100)^(y-2015)}. If the damage doesn’t occur for 100 years (say its damage due to SLR from the Antarctic ice sheet, that doesn’t start melting for 100 years) then D(y) = 0, y = 2015..2115.

So, D_total is a fixed value, that should be used for the externality costing of emitting X CO2. The time lag is irrelevant -W]

LikeLike

try

D_total = sum_y=[2015,infinity]{D(y)/(1+X/100)^(y-2015)}

[See? I don’t know this stuff. But 1/(1+X/100)^y isn’t much different from 1*(1-X/100)^y. I hope -W]

LikeLike

In the six impossible things before breakfast column, while pleased to see this discussion, I tie myself into a pretzel by agreeing with several disagreeing .arguments presented here. [Except attributing a particular type of opinion to specific groups and characterizing their age/sex/relative cleanliness is BS and counterproductive.]

The specifics of how these numbers were created are useful, and I am surprised to find they have more grounding in reality than I feared. Putting a number to collective damage is useful, but it is hard to swallow and knowing the acrobatics involved are not bogus but only tendentious is useful.

Given the intense, unrelenting, and largely successful effort to deceive in the public arena, particularly in the English-speaking world (US, Canada, Australia, UK) it is important that people be made furiously to think about what is actually going on. In my own case, I’m happy to get even sloppy numbers mixing up consumers and producers that represent the scale of real costs to everyone.

Particularly helpful are things like Hank’s children’s health item, http://www.ncbi.nlm.nih.gov/pmc/articles/PMC2516589/

LikeLike

[OK, but even accepting that, the maximum subsidy is “sales” which is still a small fraction of “externality”; so the bulk of the “subsidy” still goes to the consumers -W]

Greg was saying subsidy to FF companies was their entire market value.

Not quite sure how you arrived at sales as opposed to profits.

“Oil & gas and coal companies form one of the world’s largest asset classes, worth nearly $5trn at current stock market values.”

Click to access BNEF_DOC_2014-08-25-Fossil-Fuel-Divestment.pdf

“$331 billion. If this figure represented a country’s GDP, it would rank 36th in the world, between Denmark and Malaysia. Instead, $331 billion is the profit made in 2013 by companies involved in extracting, transporting, refining, distributing and trading in fossil fuels in the United States and Canada. ”

http://priceofoil.org/2013/09/26/profits-oil-gas-coal-companies-operating-u-s-canada/

It would seem to me that sales, market value and annual ‘subsidies’ (ie including externalities) are all of the same sort of order – around $5 trillion. Profits will be around an order of magnitude less than sales.

Anyway I would accept that the maximum annual subsidy is ‘typical profits’ and this is a small fraction of “externality”; so the bulk of the “subsidy” still goes to the consumers

LikeLike

Greg Wellman wrote

“If rates of extraction fall to a few percent of current (say, as air travel is the last big FF user after others transition) then the FF companies stocks are essentially worthless.”

Air travel does seem to require carrying fuel therefore high energy density required therefore appears difficult to transition.

Liquid oxygen and hydrogen doesn’t need much ff energy – renewable electricity can do production and cooling. Instead of working over long distances why not put effort into accelerating upwards for first 100-200 miles then glide rest of way with suborbital flights. Won’t happen overnight obviously but how long will it take compared to time to install enough renewables?

Lots can change at the longer time scales of the transition but directing enough investment into renewables to make enough of that happen seems like a fairly long timescale challenge that society can now start concentrating on without it costing too much and significantly reducing risks. ‘Carbon tax now’ does that nicely.

Without carbon tax, renewables look like unexciting ‘low risk, low return’ investment. From societal view, it should look like good return negative risk investment. While carbon tax probable can’t quite get it looking like it should, it can make it look like good return very low risk to investors. I think this goal congruence aim should be promoted.

(Nothing startlingly new, just a different framing of the problem (and solution), one that is aimed at the people who to my mind matter – investors. If we don’t get enough investment in renewables we have serious problems.)

LikeLike

I’m going to try to do the opposite of “let’s you and him fight” here.

I am still trying to wrap my head around the couple of different value calculations suggested above.

I need help from the real scientists (and, er, former scientists now in industry, or whatever) — to understand this. I think it’s something badly understood at best even by smart people, and it’s the fifth graders who need to be taught this stuff.

When I look at how we’re handling the world, then look at the economics that say all the damage is somehow captured in the calculations — I have to say “I refute it thus” and kick a rock where there should be many feet of living topsoil — that’s the actual result of economics as practiced.

So where’s it wrong and is it possible to get it right?

Not mathematically, theoretically, economically right.

Increasing topsoil and more whales right.

When I see people I respect striking sparks instead of light, well, I wish for better.

RP: you are being needlessly offensive …

W: [I don’t know why you’re being so offended …

Billy Sunday: They say I rub the fur the wrong way. I say let the cats turn around.

Help?

[kick a rock where there should be many feet of living topsoil. Do you? Around here, I certainly don’t. I’ve no doubt that there are places where the topsoil is gone, but there are many places where it isn’t. Without stats, all you have is anecdote. For example, I found http://www.globalchange.umich.edu/globalchange2/current/lectures/land_deg/land_deg.html, but irritatingly that is *per capita*, whereas you want absolute -W]

LikeLike

Well, paging down on that globalchange.umich page you link to above, there’s this:

“This figure illustrates how pervasive is the problem of soil degradation. No continent is free from the problem. Areas of serious concern include zones where up to 75% of the topsoil has been lost already. The central portion of the United States is an area of particular local concern. The practices of large scale mechanized monoculture has contributed to the decline in soil in the mid-west.”

Look at England. Perhaps it’s shifting baselines?

LikeLike

> Perhaps it’s shifting baselines?

Which you know what I mean; “Around here, I certainly don’t” is how slow change looks. Now, perhaps someone’s fooling the people at umich and central England really hasn’t lost up to 70 percent of the topsoil. You may ask “since when” — but that area wasn’t glaciated, was it? So, probably they mean since agriculture there. Not blaming the beekeepers.

LikeLike